Uncle Sam Delivers A Strong Economy

Published Friday, June 28, 2019 at: 7:00 AM EDT

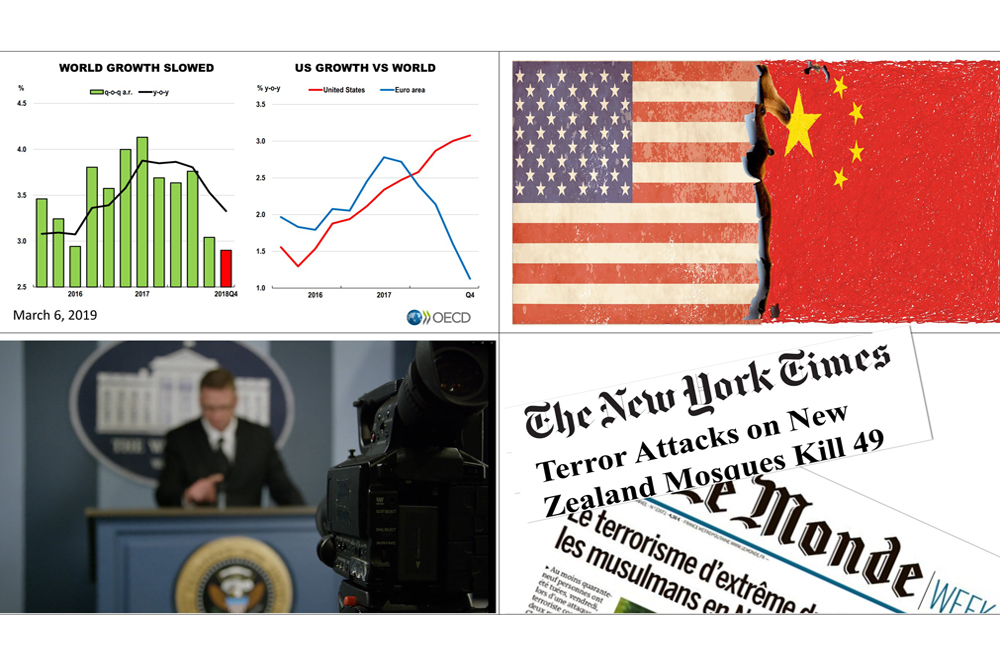

In July, amid a world of seemingly unprecedented uncertainty, the expansion enters its eleventh year, officially qualifying as the longest economic growth cycle in U.S. modern history.

Here's what going on.

Personal income, which accounts for 70% of the U.S. economy and is the key driver of the nation's growth, rose at a strong pace and broadly over the 12 months ended May 31st, and accelerated from the pace a month earlier. At the end of April, personal income had grown 3.9% over 12 months earlier; at the end of May, the 12-month growth rate rose to 4.1%.

Personal income is mostly comprised of wages and benefits paid to employees but also includes interest, dividend, proprietor and rental income, as well as payments from Social Security, Medicare, and other government programs. All four types of income tracked by the Bureau of Economic Analysis showed strong growth in the 12 months through May.

Real disposable personal income after inflation and taxes rose by 1.7% in the 12 months through May. That's as good as the 1.8% compounded growth rate in the five-year peak during the last expansion. The 1.7% rate of growth in the real DPI 12-month pace through May was an improvement over the 1.5% rate in the 12-month period ended in April.

The Standard & Poor's 500 index closed on Friday at 2,941.76, fractionally lower than its all-time closing high of June 20th.

Despite real financial strength of American consumers and hovering at the all-time high price for shares in U.S. companies, consumers are not becoming dangerously overconfident, based on the newly released consumer sentiment survey from The University of Michigan. While consumers are optimistic, the consumer sentiment index is far below levels that preceded the irrationally exuberant period before the tech stock bubble of 1999.

Happy Fourth of July!

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

2023

2022

2019

2018

2017

2016

2015

|

|

||

|