10 Things: New Education Tax Breaks For A Child Or Grandchild

Published Friday, August 3, 2018 at: 7:00 AM EDT

1. If you have a child or grandchild, for the first time ever, you can now pay tuition for kindergarten through 12th grade at private, public or religious schools with money saved in tax-advantaged 529 college savings accounts.

2. Thanks to the Tax Cuts And Jobs Act (TCJA), you now can draw up to $10,000 tax-free per student from a 529 plan, which is a tax-advantaged program sponsored by states, state agencies, and educational institutions.

3. While your contributions to a 529 plan are not deductible, earnings grow free of federal income tax on withdrawals to pay for qualified school expenses.

4. You are not limited to 529 plans sponsored by your state. You can choose from a long list of 529s sponsored by other states and choose the right one for you. Call us if you want help with this.

5. A big relief is that the new law leaves the student loan interest deduction unchanged at $2,500. Some lawmakers wanted to scrap it, but the majority rallied to the tax break's defense. Americans owe some $1.48 trillion in student debt, and it's definitely a thing to watch.

6. When student loans are cancelled due to death or disability, they now become tax-exempt. Till now, the debt would be added to the income of a deceased or disabled individual. This new tax benefit is not retroactive, and only affects loans taken from 2018 through 2025. Congress may choose to extend this tax break.

7. The TCJA axes taxes on alimony payments, so custodial parents should have it easier qualifying for need-based aid. Their income won't be as high as what's reflected in tax records, which is what federal aid officials rely on to determine who to help and by how much.

8. Tax deductions for interest on home equity loans and lines of credit were eliminated. These are major sources of education funding, businesses, and a range of other expenses. It's gone.

9. The new federal levy on colleges with big endowments could result in still-higher tuition costs.

10. Education tax breaks were boosted overall by the TCJA, but you almost must be a financial professional to manage the complexities of funding the education of a child tax-efficiently and with low investment expenses.

This article was written by a veteran financial journalist. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

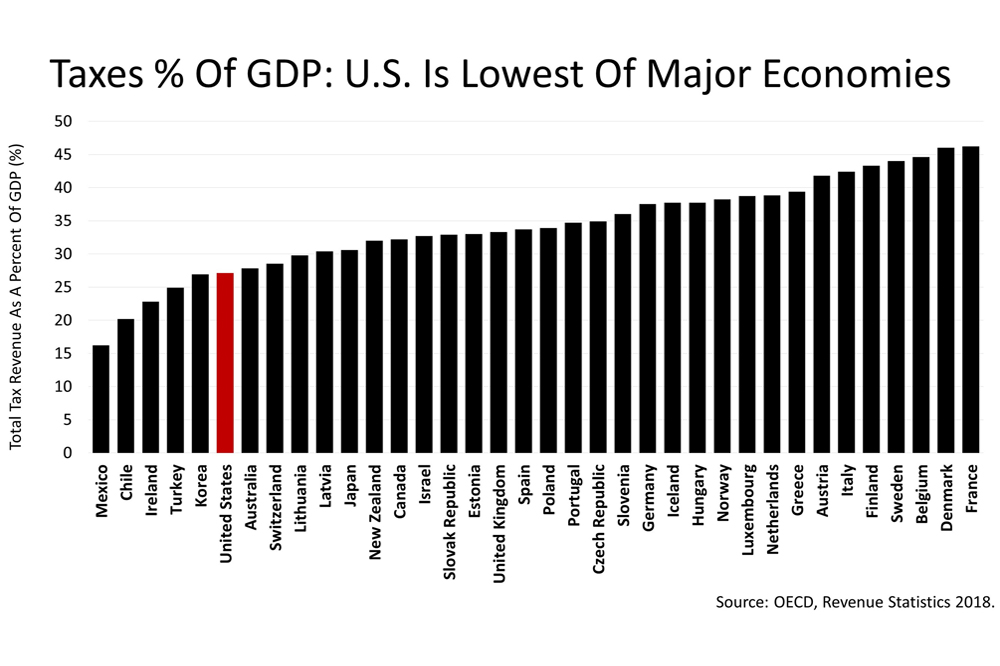

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

2023

2022

2019

2018

2017

2016

2015

|

|

||

|