A Spectacular Quarter For U.S. Stocks Just Ended

Published Friday, March 29, 2019 at: 7:00 AM EDT

The first quarter of 2019 ended on Friday with a gain in the Standard & Poor's 500 stock index of 13%, the best quarterly performance since the third quarter of 2009.

Publicly traded shares of large American companies, in decades past, averaged about a 10% total return per year. So, a double-digit gain in a three-month period is extraordinary by historical standards.

The strong performance in stocks occurred despite a long list of worries, including:

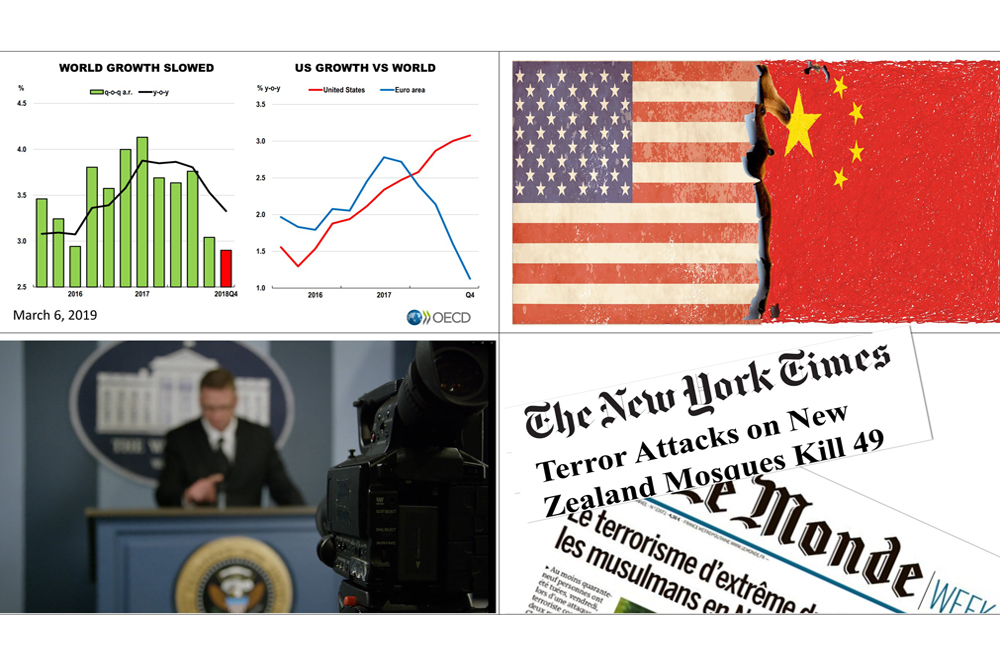

- inversion of the yield curve, a bad sign that has preceded every recession in post-War U.S.

- a U.S. trade war with China, the world's second-largest economic power

- signs of a sharp slowdown across Europe and in China

- lower earnings growth forecasts by Wall Street analysts for S&P 500 companies for 2019

No one can predict the future of the stock market or any particular investment with certainty. Just a week ago, the S&P 500 fell by 1.9% in a single day! A key growth investment in a broadly diversified portfolio, the S&P 500 index suffered a 19.8% plunge from September 20th's all-time closing high to the Christmas Eve closing low of 2,351.10. Closing on Friday at 2834.40, the S&P 500 stood just shy of its all-time closing high of 2930.75 on September 20th, 2018.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

2023

2022

2019

2018

2017

2016

2015

|

|

||

|