Despite Crises, Economic Fundamentals Are Strong

Published Friday, March 15, 2019 at: 7:00 AM EDT

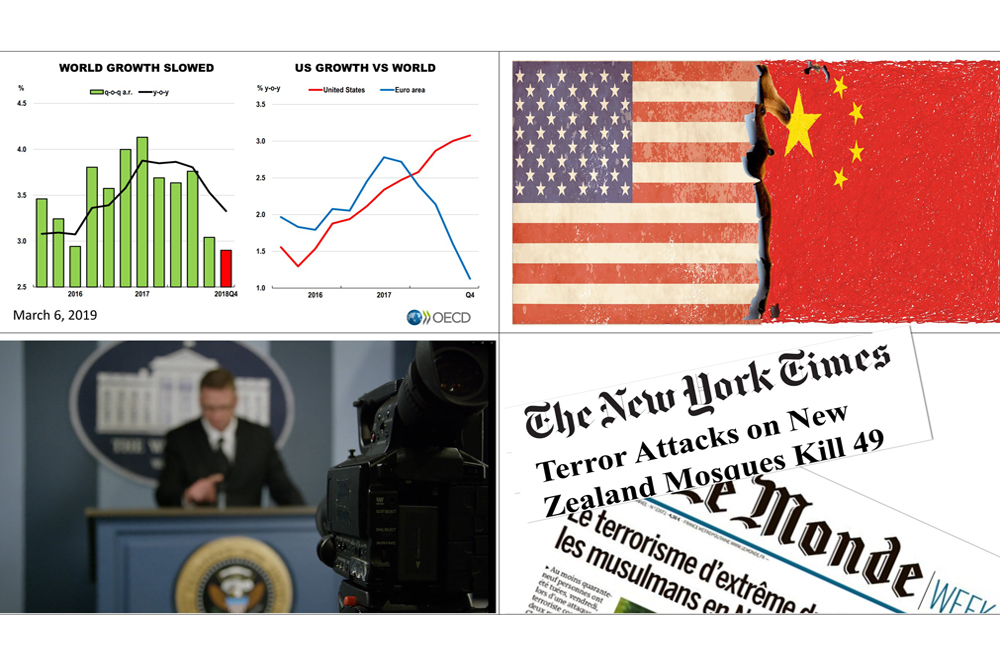

Europe's economy slowed sharply, a U.S.-China trade war loomed, fears of a real war with North Korea grew, while U.S. politics sank deeper into chaos, and a gunman massacred at least 49 innocents attending services at a Christchurch, New Zealand mosque, even as they prayed. It was a week of crises.

Since 1957, the internal rate of return on American stocks has been 6.9%, and there were plenty of crises all along the way.

The Standard & Poor's 500 stock index closed at 2,822.48 on Friday, up sharply from 2,743.07 a week ago, and rebounding the close of 2,803.69 two weeks ago.

A key growth investment in a broadly diversified portfolio, the S&P 500 index is volatile, unpredictable, and suffered a 19.8% plunge from September 20th's all-time closing high to the Christmas Eve closing low of 2,351.10. Despite a week when the world seemed full of crisis, U.S. stocks endured and the uncertain struggle toward progress — which can never be guaranteed — continued at its seemingly relentless pace.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

2023

2022

2019

2018

2017

2016

2015

|

|

||

|