A Dramatic Pause, As Expansion Breaks Longevity Record

Published Friday, June 21, 2019 at: 7:00 AM EDT

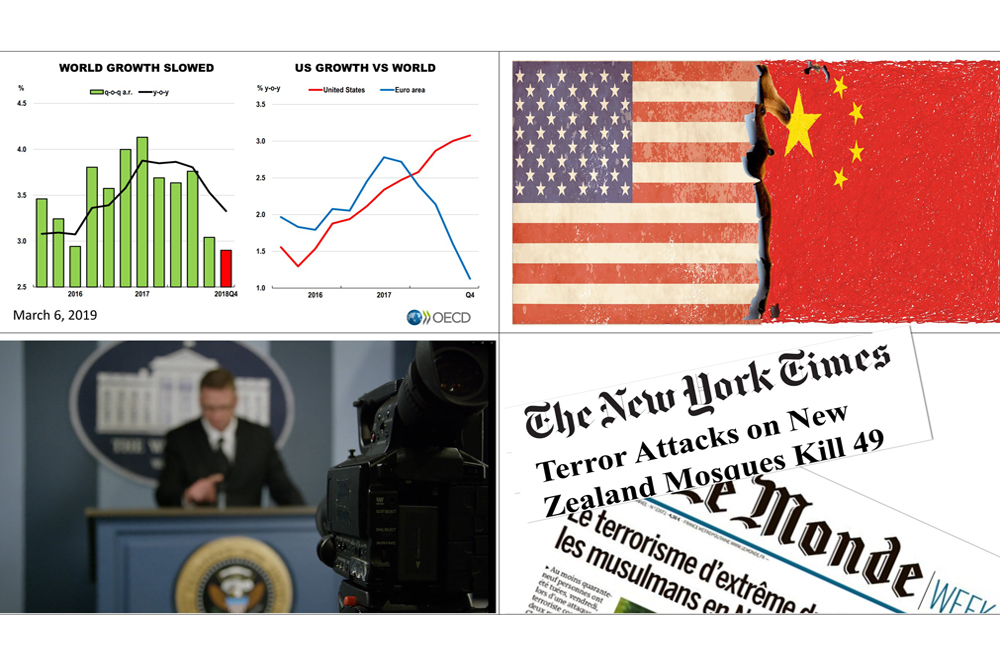

With the start of the second half of 2019, this expansion officially sets a new record as the longest growth cycle in modern U.S. history. However, growth has moderated lately. The U.S. Leading Economic Index (LEI) in May was unchanged from April. It's a dramatic pause after 10 years of strong growth.

"While the economic expansion is now entering its eleventh year, the longest in US history, the LEI clearly points to a moderation in growth towards 2% by year end," according to the economic team at The Conference Board, a big-business sponsored group that is responsible for tracking the monthly U.S. LEI.

From The Great Recession of 2008, which was the worst period of negative growth since The Great Depression, the current growth cycle began in April 2009, and GDP grew only modestly until 2015. Then, real wage gains began accelerating, propelling stronger than expected growth for over four years. Though U.S. growth recently leveled off, it's been a spectacular expansion, by modern historical standards.

The Federal Reserve was nimble in reversing its interest rate policy in recent weeks, as fear of trade wars and, now, a real war with Iran, heightened uncertainty, and the expansion is poised to extend into 2020. However, the Fed has not always been accurate in the past in forecasting the economy. Far from it!

The Fed caused every recession since 1954 by misreading the economy, tightening credit too much and choking growth. They came close to doing it again earlier this year, but their quick about-face in May has enabled the long expansion to continue for now.

Fritz Meyer, an independent economist whose research we license, says the Fed's fear of inflation is overblown. Since this expansion began, the Fed's forecast for inflation has been wrong, he says. The Fed's policy reversal in recent weeks, articulated in its public pronouncements in May and June, indicates that the Fed could be rethinking its inflation model.

Watch for the Fed to show less fear of inflation in the months ahead. A tectonic shift in the way the Fed views inflation could fuel continued growth. Or the Fed could make a mistake.

The big picture significance of this chart is that the LEI has historically rolled over very definitively months before recessions in the past. Hence, the pause in the LEI is pregnant with drama.

The Standard & Poor's 500 index broke another all-time high with its closing price of 2,954.18 on Thursday. The index closed on Friday at 2,950.46.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

2023

2022

2019

2018

2017

2016

2015

|

|

||

|