Surprisingly Good Productivity, Jobs, Inflation And Trade News

Published Friday, May 3, 2019 at: 7:00 AM EDT

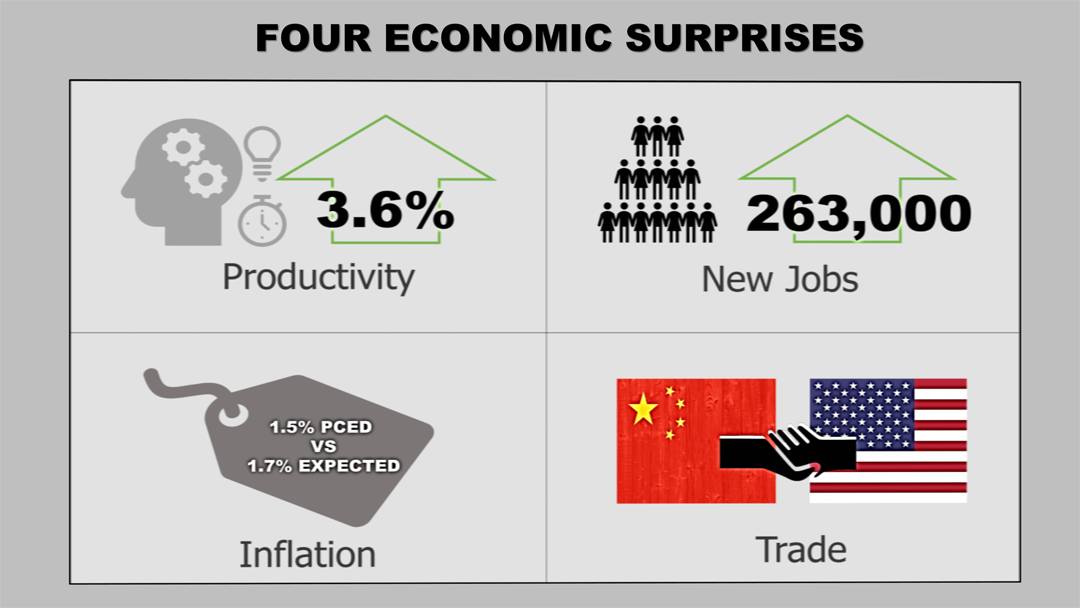

Financial and economic news this past week was very good on four fronts: productivity, employment, inflation and trade.

The unemployment rate sank to 3.6%, the Labor Department announced on Friday morning, the lowest level since December 1969. The economy created 263,000 new jobs last month, far more than the 190,000 expected.

Inflation data released by the Bureau of Economic Analysis on Monday was much lower than expected, even though the job market is tight, and wages are rising. In addition, Treasury Secretary Steven Mnuchin said in a TV interview that he expected a finalized U.S. trade agreement with China next week, averting a trade war with the world's No. 2 economy.

But the newly released productivity data was the biggest and most positive surprise.

The Congressional Budget Office, the nonpartisan research arm of the legislative branch of the federal government, projects productivity will grow 1.8% annually through 2029, and the productivity rate for the past five years annually averaged just 1.3%. In contrast, newly released data shows that productivity surged at a quarterly annualized rate of 3.6% for the period ended March 31st. That's twice the long-term rate projected by the CBO.

Productivity enables employers to pay higher wages without raising their costs. Wages were up 2.8%, according to the latest Bureau of Economic Analysis figures ended March 31st, 2019, but the 3.6% productivity gain more than offset the cost of rising wages and benefits. Wages and benefits are the biggest causes of inflation, but companies are finding that rising wages are offset by productivity gains.

With wages rising without triggering inflation — a condition that defies conventional economic wisdom — the Federal Reserve is under no pressure to raise interest rates. This is not just a Goldilocks economy. Goldilocks is on steroids!

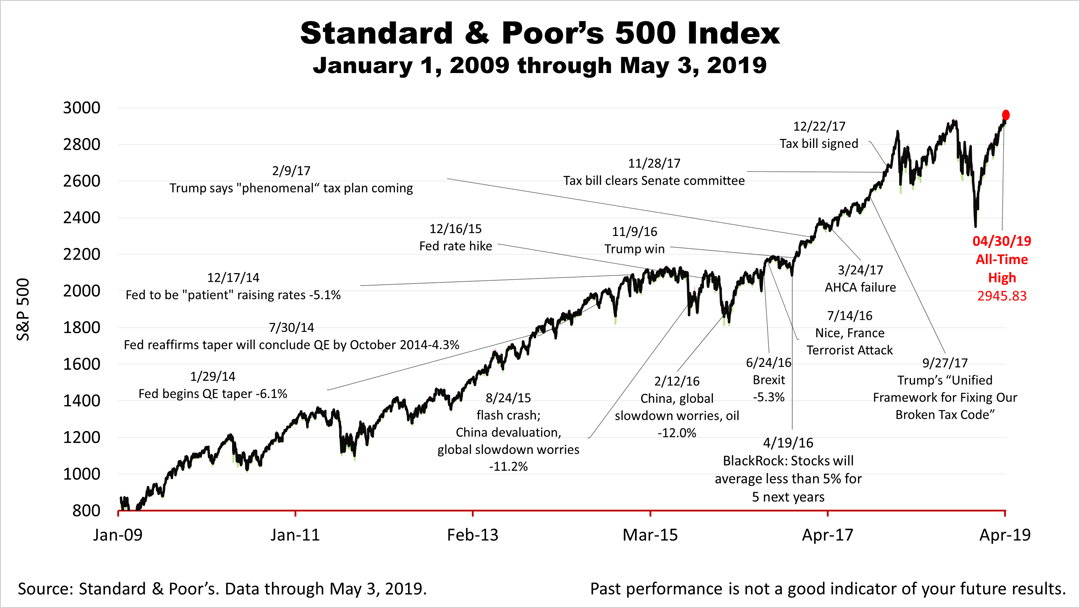

The Standard & Poor's 500 index closed on Friday at 2,945.64, fractionally off last Friday's record high of 2,945.83.

No one can predict the market's next move and past performance is not indicative of your future results. Stocks are only one asset class in a long-term strategically-designed portfolio. Stock prices don't always reflect fundamental economic trends but over the long-run economic fundamentals are the key determinant of corporate earnings, which drives stock prices. Since stocks are the main growth engine for Americans' retirement portfolios, this week's unusually good economic news made long-term optimists look smart.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

2023

2022

2019

2018

2017

2016

2015

|

|

||

|