China Trade War Sparks Fear But Not Stock Losses

Published Friday, May 10, 2019 at: 7:00 AM EDT

While fearful headlines about the U.S. - China trade war dominated the news, stocks gyrated throughout the week.

The New York Times senior economics correspondent reported that Moody's Analytics expects the trade war to "subtract 1.8 percentage points from G.D.P. growth and cause unemployment to rise."

CNBC reported that it could cost the average American family between about $500 and $800. "Further escalation of trade tensions would have dire consequences for both protagonists and the rest of the world," Oxford Economics told CNBC.

U.S. stock investors were less alarmed.

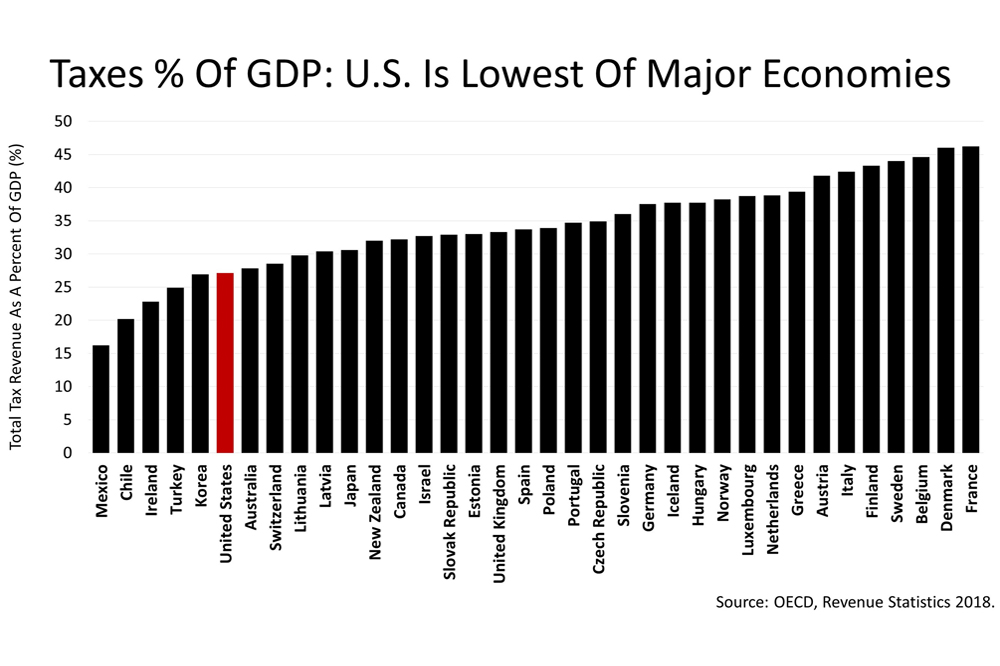

The U.S. imported $524 billion from China in 2017, and imports from China accounted for 59% of the U.S. trade deficit. More importantly, however, U.S. exports to China comprise just 1.0% of U.S. GDP. In a $19-trillion-dollar economy, with 1.0% attributable to exports to China, the China trade war may be overdone.

China's exports to the U.S. comprise 4.1% its GDP, and China has lots more to lose from the trade war than the United States.

The Standard & Poor's 500 was volatile last week but closed at 2,881.40, about 2% from its all-time high on April 30th.

President Trump is now threatening to add more tariffs of 25% on an additional $325 billion of imports from China. That would come on top of the 25% tariffs that went into effect on $200 billion of imports from China. So, more volatility for stocks in the near-team is certainly possible.

No one can predict the market's next move and past performance is not indicative of your future results. Stocks are only one asset class in a long-term strategically-designed portfolio and stock prices don't always reflect fundamental economic trends. However, over the long-run, economic fundamentals are the key determinant of corporate earnings, which drives stock prices, and economic fundamentals remained strong.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

2023

2022

2019

2018

2017

2016

2015

|

|

||

|