Three Stories Affecting Your Wealth This Week

Published Friday, May 31, 2019 at: 7:00 AM EDT

It was a difficult week for investors, as the Standard & Poor's 500 stock index closed lower for the third straight week. The S&P 500 Index sank 1.3% on Friday. Closing at 2,752.06, the S&P 500 index was 6.5% from its all-time high on April 30th.

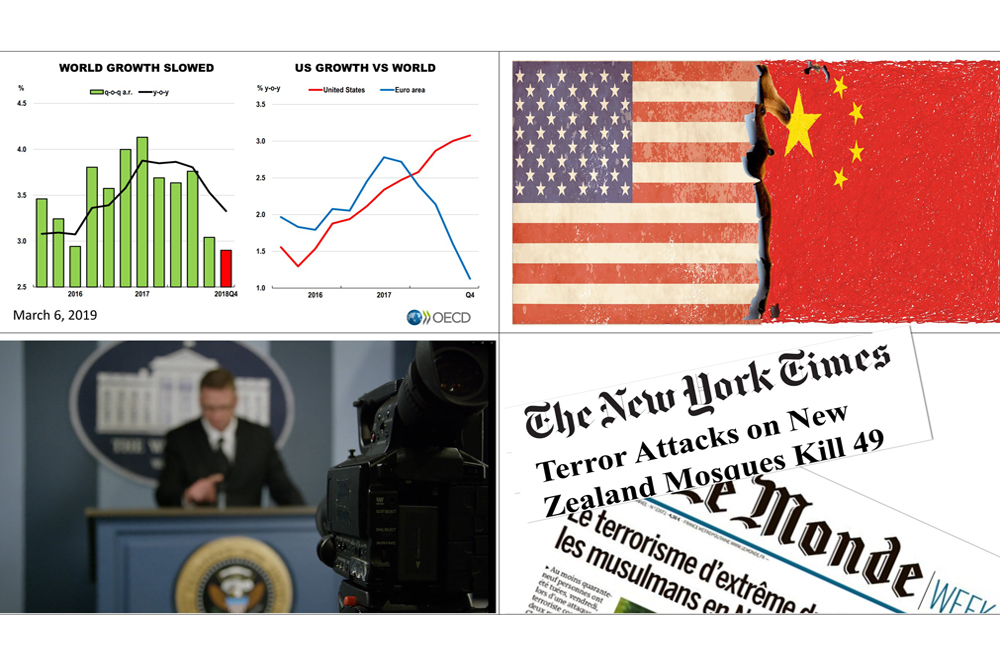

Friday's stock market drop came after President Donald J. Trump threatened late on Thursday that, unless the flow of South American migrants crossing into the U.S. through Mexico is reduced, the U.S. would impose a 5% tariff on imports from Mexico starting June 10th, which would raise the levy on goods coming from Mexico by 5% a month to 25%.

Meanwhile, the trade war with China showed no sign of being averted and the Chinese are making the dispute a point of national pride. The prospect of fighting a trade war on two fronts caused the market to slump on Friday.

The other story that unsettled investors this past week was a slump in bond yields and the deepening inversion of the yield curve. Every recession in post-War America was preceded by an inversion of the yield curve, which is when the yield on a 90-day T Bill is higher than the yield on a 10-year U.S. Treasury bond. A yield curve inversion does not necessarily mean a recession will follow. The Fed could change its policy and lower short-term rates, but the yield curve inversion is a negative indicator that needs to be watched.

The last of the three big stories affecting investors this past week was the passage of sweeping tax legislation by the U.S. House of Representatives on May 29th. Entitled, "Setting Every Community Up for Retirement Enhancement Act of 2019," the SECURE Act is expected to be passed by the Senate and has the support of President Donald J. Trump. Although the legislation may not be signed into law until late this year, individuals with retirement accounts should consider how its enactment will affect them and their beneficiaries.

Among the legislation's sweeping changes, it would kill "stretch" Individual Retirement Accounts (IRAs) and represents a move to higher taxes on IRA beneficiaries. Non-spouse beneficiaries of IRAs would no longer be permitted to defer taxes on payouts of inherited IRAs over their expected lifetime after 2019. Under current rules, you could leave an IRA to your children or heirs who may take distributions from that IRA based on their life expectancy. This can allow those inheriting IRAs to stretch the deferral of taxes over many decades, and the IRA account compounds without being taxed in this period. Under the proposed change, heirs would be required to distribute an inherited IRA over 10 years. Tax planning requires a qualified tax professional and personal attention, and while this is an early warning about an important issue affecting strategic long-term tax planning, it is not intended as personal tax or legal advice.

The economy has been expanding for 119 consecutive months, a month shy of the longest post-War expansion in the 1990s. Current fundamentals are strong, with the U.S. Leading Economic Indicators recently ticking higher, unemployment at a 50-year low, benign inflation and surging productivity. Please watch for our updates to learn details about ways to shield yourself and your beneficiaries from higher taxes on IRA payouts in the weeks ahead as well as views on the crosscurrents in the economy and financial markets.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

2023

2022

2019

2018

2017

2016

2015

|

|

||

|