How Misperceptions Spread And Cause Confusion On Money Matters

Published Friday, March 8, 2019 at: 7:00 AM EST

U.S. jobs data triggered fearful headlines on Friday. It's a cautionary tale of how misperceptions spread in an instant and cause mass confusion about money matters.

From The New York Times to specialized news outlets, like The Street, headlines were uniformly grim after the jobs data was released by the government on Friday morning.

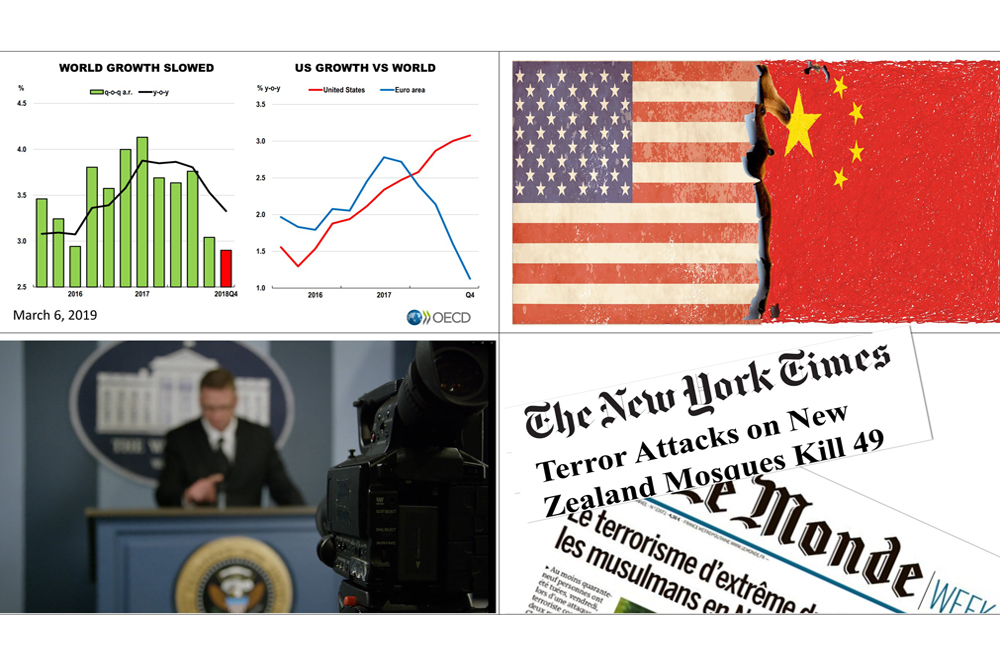

The bad report showing that just 20,000 jobs were added by the economy in February was likely an aberration. The blue bar chart in the lower-right indicates the drop in new job creation occurred largely due to a plunge in construction jobs, which was caused by bad weather across the country. Construction hiring plunged, suffering a net loss of 84,000 jobs in February. This helped trigger the bad headlines, but job losses in construction of this magnitude happen once in a while. The last net loss of jobs in construction occurred in 2016.

While the headlines were mostly negative on Friday, new data went unnoticed in the press showing average hourly earnings for blue-collar workers rose by 1.7% in the 12 months through December, and by 11.6% in the 10 years through the end of 2018. To be clear, in the last decade, blue-collar Americans saw an 11.6% gain in that purchasing power after inflation. When you include managers and white-collar employees, real hourly earnings of all U.S. employees was up 11.5% over the 10 year period, as blue-collar workers actually saw slightly larger wage gains over the past decade than the total population of all U.S. employees. Most important, the American consumer contributes 70% of U.S. economic growth, and real wage gains translate into increased spending and drive economic growth.

The aberrant jobs report also distracted from new data showing the strong rate of growth in the productivity of U.S. workers. This extended an important fundamental economic trend that's been unfolding over the last three years.

Productivity increased by 1.9% in the final quarter of 2018. That was down from 2.8% in the third quarter of 2018 but remained at about double the 1% rate of productivity growth averaged annually in the five years through December 2018. Productivity gains directly offset the inflation. This creates a sweet spot in which employee wages rise without triggering inflation fears.

The Standard & Poor's 500 stock index closed at 2,743.07 on Friday, down from last Friday's close of 2,803.69. The decline broke the string of five straight weekly gains for the benchmark of U.S. public equities. The index had been edging closer to its all-time closing high on September 20th, 2018.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

2023

2022

2019

2018

2017

2016

2015

|

|

||

|