Despite December Turbulence, Economy And Business Optimism Were Strong

Published Friday, January 18, 2019 at: 7:00 AM EST

While the stock market plunged in December and headlines turned grim, small business owners overwhelmingly remained optimistic about the economy and business conditions.

The National Federation of Small Business Optimism Index remained basically unchanged in December, drifting down by just four-tenths of 1%, to 104.4, amid the worst December since 1931.

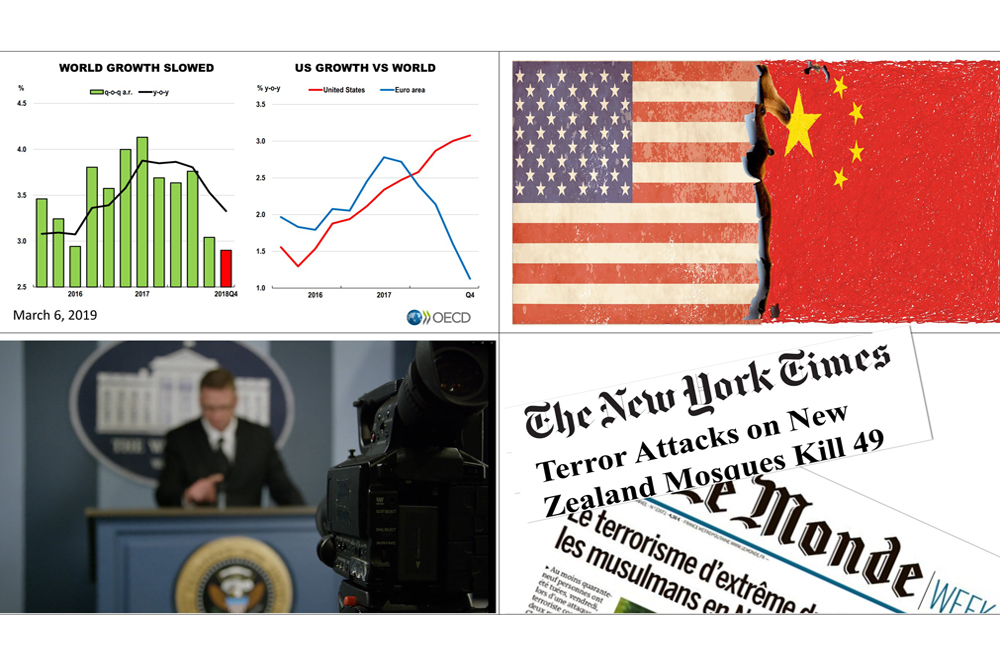

Stocks lost 14% of their value in the fourth quarter and it was the worst quarterly loss since 2011. The Fed was sticking with its plan to hike rates, the political crisis in Washington was making new headlines daily, a trade war with China loomed, and uncertainty blemished Europe's economic growth outlook.

Nonetheless, in the week ended January 12th, the Department of Labor's advance figure for seasonally adjusted initial claims for unemployment was 213,000, a decrease of 3,000 from the previous week's unrevised level of 216,000. The four-week moving average was 220,750, a decrease of 1,000 from the previous week's unrevised average of 221,750.

On the heels of last week's stronger than expected job-creation report for December, this reinforces a strong employment situation, and jobs fuel personal income of America's consumer economy.

The Standard & Poor's 500 — a key growth engine in a broadly diversified portfolio — closed on Friday at 2,670.71, compared with 2,596.26 a week earlier, extending a rebound from the 19.8% plunge from September 20th's all-time closing high to the Christmas Eve closing low of 2,351.10.

Please let us know if you would like a report summarizing the 4Q2018 financial and economic conditions.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

2023

2022

2019

2018

2017

2016

2015

|

|

||

|