Prudence Requires Positioning Portfolios For An Economic Expansion

Published Friday, January 6, 2023 at: 8:54 PM EST

U.S. central bankers are likely to be criticized by historians for not taking inflation serious sooner, but the Federal Open Market Committee’s (FOMC) aggressive policy begun in March 2022 is working, data released Friday morning show.

The progress of the United States, despite political discord in Washington, D.C., is notable. The post-pandemic inflation crisis has been managed well enough by the Federal Reserve System to require planning for the next expansion cycle! This is a good new problem to have.

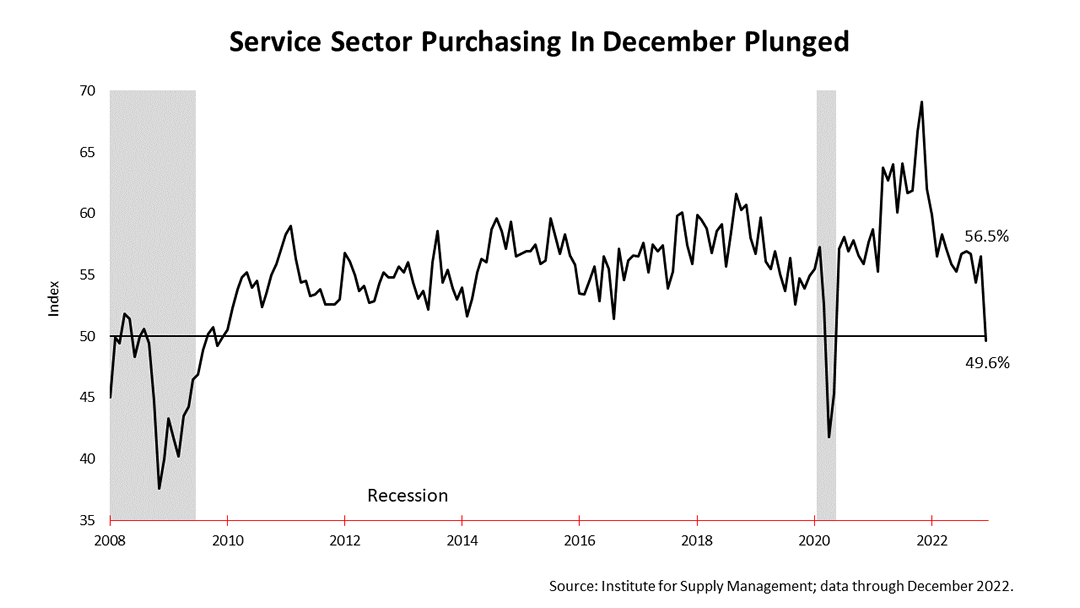

After 10 months and perhaps the harshest monetary tightening in U.S. history, the economy evidenced sure signs of slowing in December, according to data released Friday. Purchases in the service sector cratered in December.

In addition, for the one-year period ended November 30, 2022, the appalling annualized inflation rate soared in the first seven months to 10.6% but slowed to a mere 2.5% in the last five months of the period, economist Alan Blinder said in a Jan. 6, 2023, column in The Wall Street Journal. To be clear, the Federal Reserve target of 2% inflation is not far off.

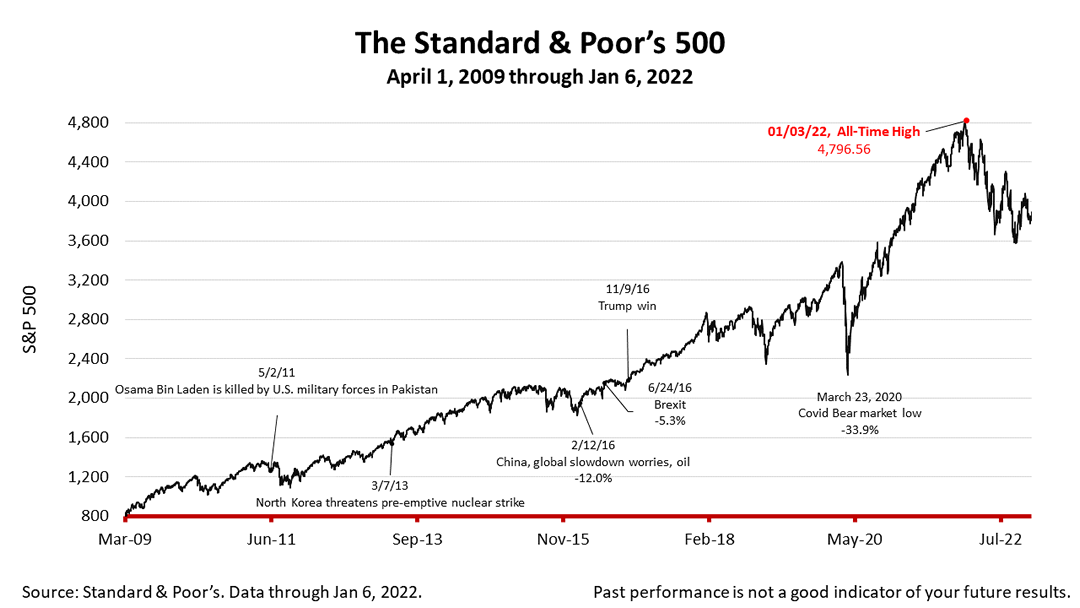

The Standard & Poor’s 500 stock index closed Friday at 3,895.08, gaining +2.28% from Thursday and +1.44% from a week ago. The index is up +74.09% from the March 23, 2020, bear market low and -18.79% lower than its January 3rd all-time high.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

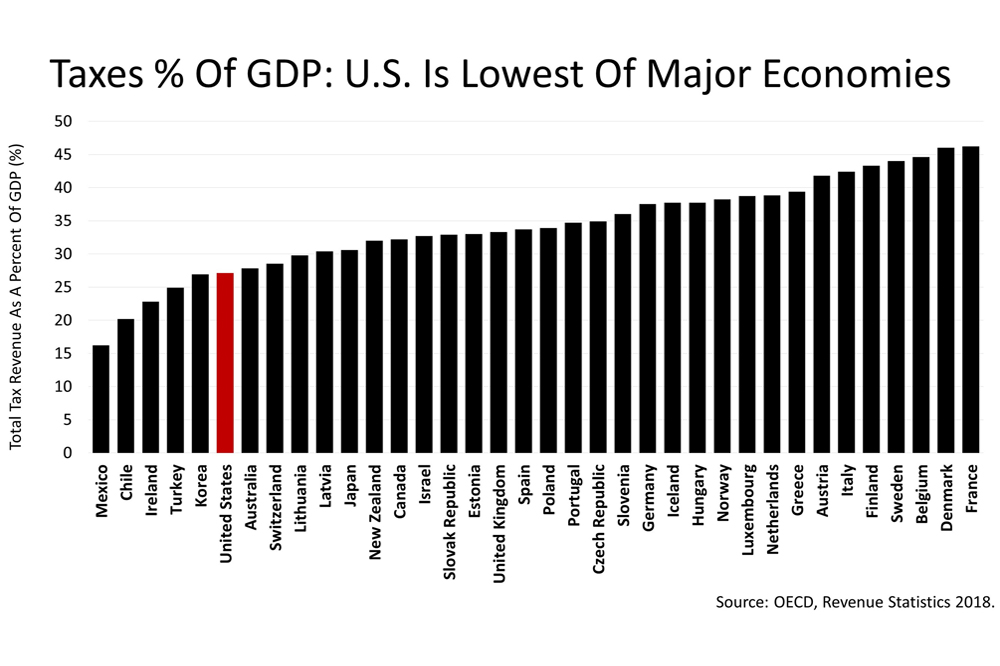

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

2023

2022

2019

2018

2017

2016

2015

|

|

||

|